Nordhealth | Oslo | 2023

Insurance Claim Process

Objectives

The UK insurance claim process is notoriously complex due to strict regulations and the extensive information required from insurance companies. To improve user experience, we redesigned the claims flow to streamline form completion, reduce friction, and incorporate automation. By optimizing efficiency and simplifying the process, we aimed to make filing claims quicker, more intuitive, and less overwhelming for users.

My role:

Analyzed the existing flow to identify inefficiencies

Worked closely with the UX researcher to prioritize scope and significance of potential improvements

Conducted user testing to gather insights and feedback

Led the ideation and redesign of the flow, enhancing both UX and UI for optimal user experience

This project was a joint effort between myself and Odette Jansen, our former Head of UX Research. Our collaboration process is detailed in an article co-written by us, shedding light on our process and outcomes. I encourage you to read the article we published:

Areas of improvement

Through stakeholder sessions, we mapped out and analized the old insurance flow, giving us an overview of what it took to file a claim.

We identified critical pain points in the current product, involving a select group of users, our Head of UX research, and myself. These discussions were instrumental in mapping out the redesign strategy for the insurance workflow. We created a list, and marked what may be in scope for this project, and rated them in the order or importance and level of impact.

Tasked with updating our design patterns, I seized this opportunity to redesign and improve our forms, enhancing usability and visual hierarchy.

Optimizing the Insurance Claims Process

After redesigning the patient and client forms, I shifted focus to streamlining insurance claims. Research showed that filing claims was time-consuming and prone to errors. To address this, we automated key steps, reducing cognitive load and improving accuracy.

Traditionally, clinics manually entered insurance decisions line by line after receiving printed assessments. We simplified this by automating the update process in Provet Cloud, significantly reducing manual work and minimizing errors.

Before / after

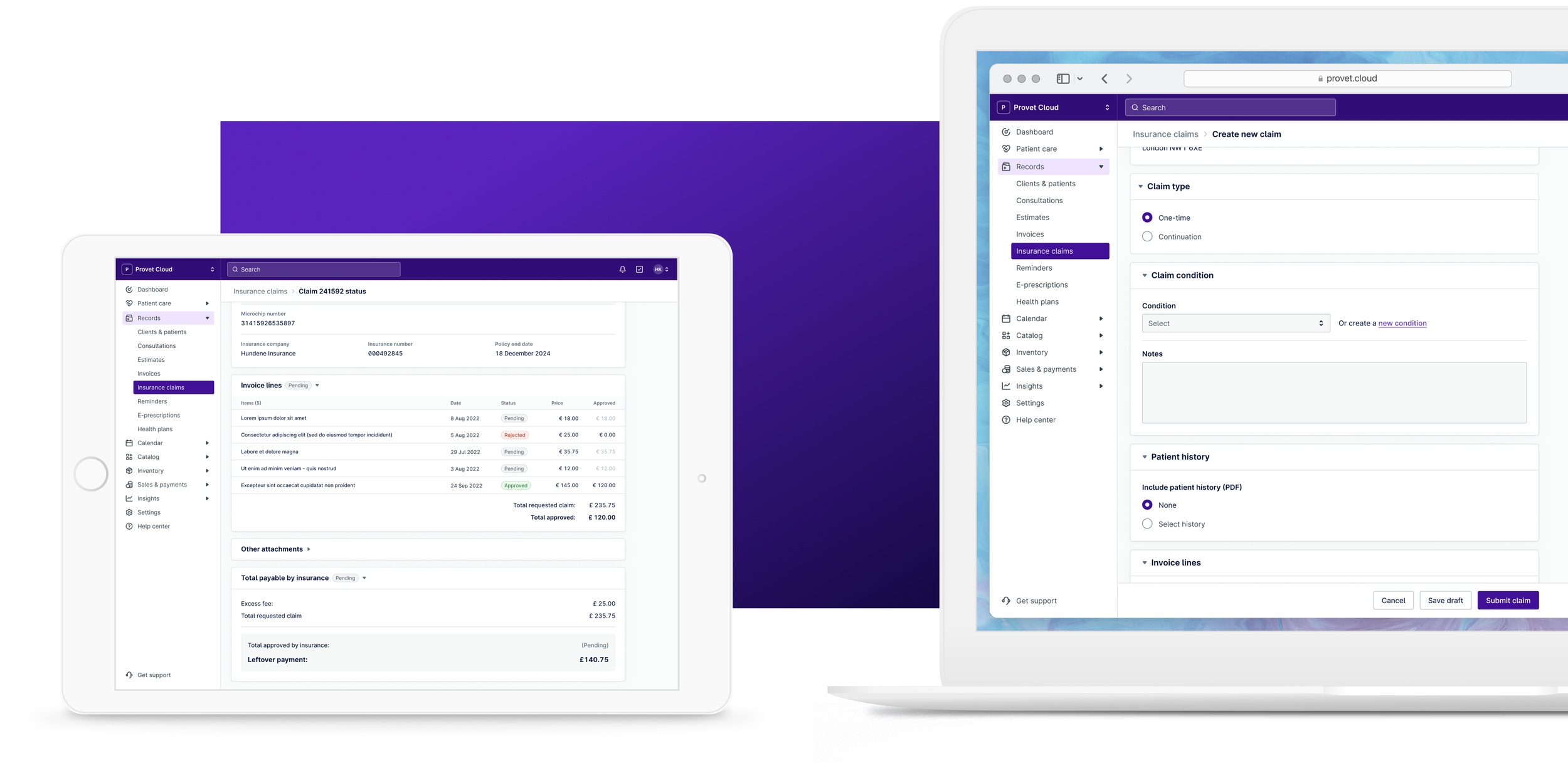

Below are some examples of before and after redesigning the insurance claim process for the UK market.

The redesigned insurance claim filing process substantially enhanced the user experience, making it more efficient and reducing the time required to complete it. By integrating automation and adopting a more user-centric design approach, we significantly decreased cognitive load and minimized the likelihood of errors, leading to a smoother, more intuitive interaction for users. These data were gathered through user interviews, CSAT, and using Pendo.

Through strategic use of visual hierarchy and improved form design, we guided users more effectively through the submission process, ensuring essential fields and any missing information were conspicuously highlighted.

Furthermore, we adapted a simplified version of this flow for the Nordic countries, where the insurance claim process is less complicated than in the United Kingdom, tailoring our solution to regional specificities and requirements, and ensuring an optimized user experience across different markets.